Image source: https://image.slidesharecdn.com/applemsft-160411202601/95/apple-vs-microsoft-52-638.jpg?cb=1460406472

Currently, the institution's capital format is facing many challenges indeed the windows and windows keep division. This has been facilitated by contemporary trend in the IT sector wherein "tablets and sensible phones have been introduced reachable in the market" (Charles, p., 34). This has caused the retailing users reaching for them as opposed to the classic version of laptop. To get closer the pageant, Microsoft Corporation intends to release windows eight beta. This will facilitate the corporation's market trend in a glorious means (John et al, forty three). For instance, the common debt ratio and consideration rate for the 2 S&P rating from AAA to B, derived from S&P(2006) because of universal and deficient's rating and ratios changed into as follows :

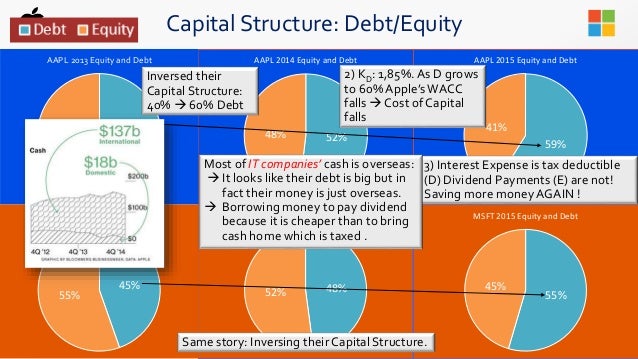

Table A provides the common general debt ratios for ratings from AAA to B. with connection with the table it ought to nonetheless be true to declare that it ought to nonetheless be a bent for a construction institution's bond rating, at the side of Microsoft corp. to shrink as the financial leverage increases in the capital format. As the institution increases its financial leverage, volume in the capital format in the bond rating drops. Microsoft Corporation's capital format has transformed lately in a selection it's just now not impressing and fast measures deserve to be positioned in place so to preserve transparent of general fall of this institution.

This is a assertion examined by Territory Manager at Microsoft Corporation, Mr. Charles Clark." Currently, the institution's capital format is facing many challenges indeed the windows and windows keep division".

In summation, this roughly capital format doesn't have compatibility to a corporation of such category due to some purposes,that contain tax rate; currently the institution's tax rate has gone down as in comparison with some years back, of that is centrally to what is anticipated of getting moderately high tax rate. Also optimum of its companions do now not seem to be contented with their contemporary state. Again this institution is at the verge of loosing the mandatory decrease premier debt really worth that is a key thing to conserving investors. . Finally the leadership type of the institution has a tendency to shift from aggressiveness to a conservative institution, which makes it less prone for that reason no an lousy lot earnings expected.

Komentar

Posting Komentar